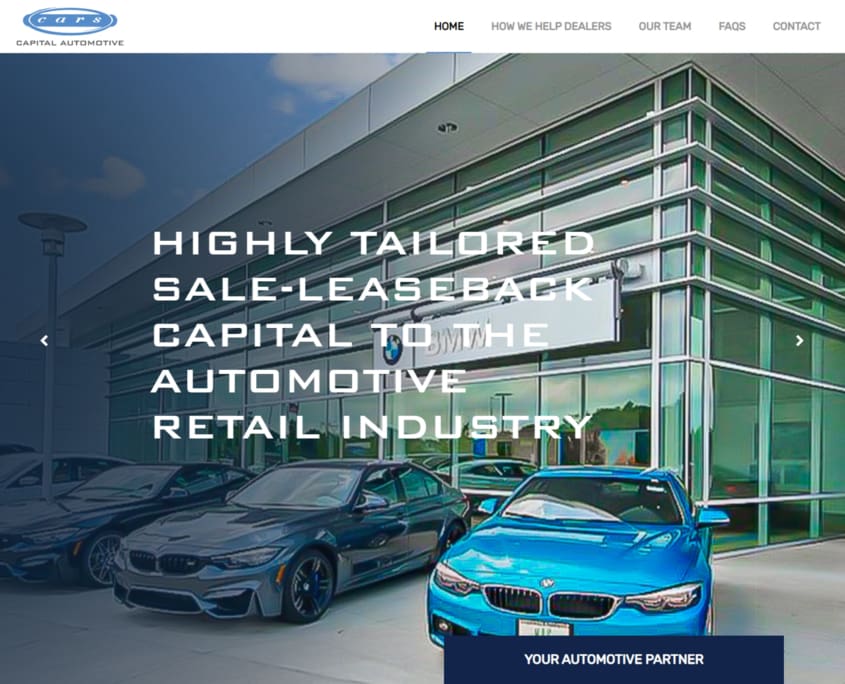

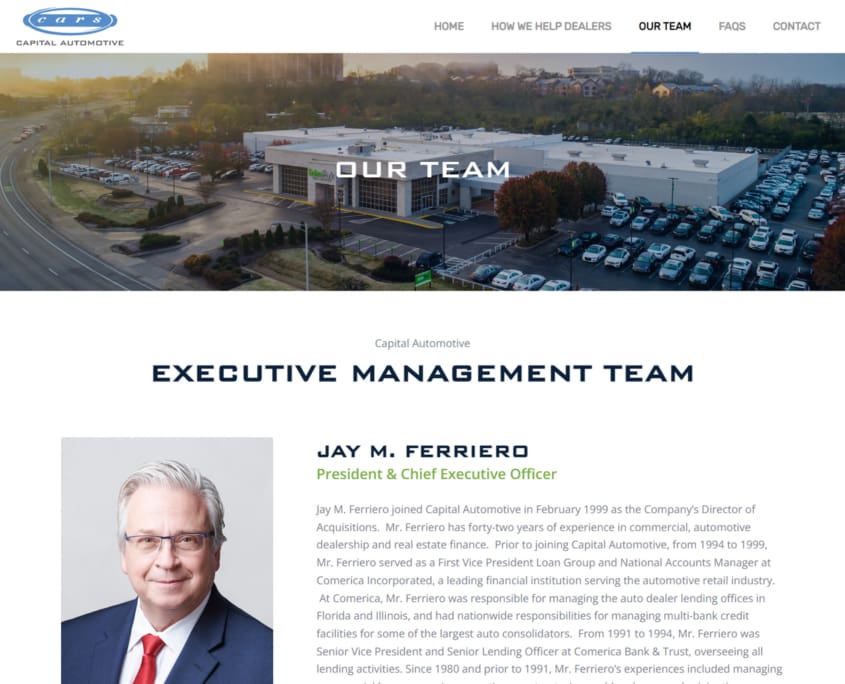

Capital Automotive

Our Task

Task

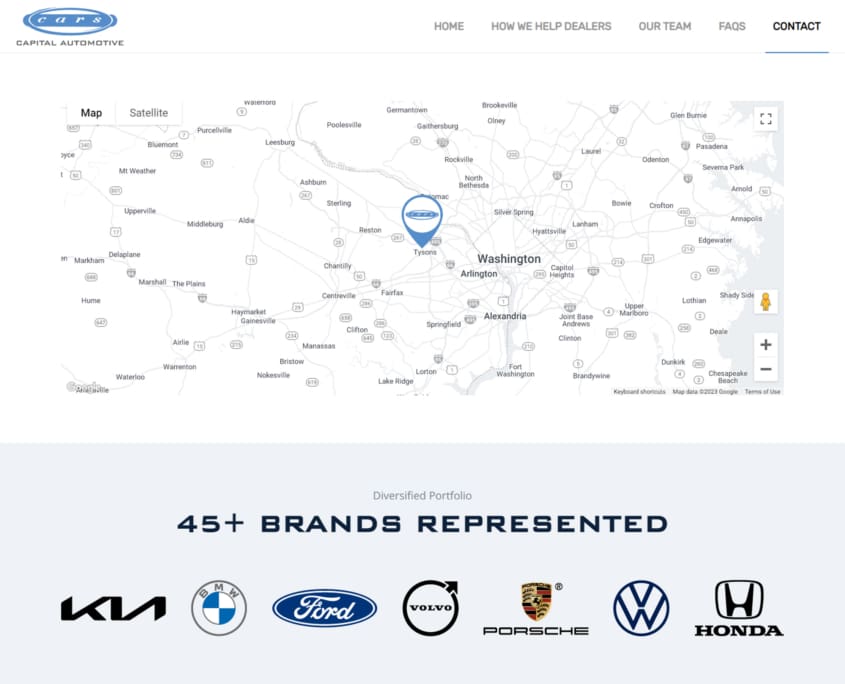

Create a new Website for a Self-Managed Real Estate Company that provides Sale-Leaseback Capital to Automotive Dealers:

Skills Involved

Skills

High Sierra Pools website was created with:

- Adobe Photoshop

- Adobe Illustrator

- WordPress

- HTML

- CSS

About Capital Automotive

About Capital Automotive

Sale – Leaseback:

With a Tax Deferral Option in the U.S.

Through a sale-leaseback transaction, automotive dealers sell their real estate to Capital Automotive and then lease it back. This unique arrangement allows dealers to tap into 100% of the equity in their real estate while maintaining long-term control of their property.

Dealers frequently use the capital received from transactions for acquisitions, operations expansion, and to fund new lines of business. Dealers also achieve the flexibility to pursue other personal goals such as estate planning, liquidity, or diversification. Additionally, the seller may defer capital gains taxes in the U.S. through our Operating Partnership Unit Program.

Capital Automotive has also become a viable alternative for many dealer groups considering selling their operations because dealers may maximize their proceeds by bifurcating the sale of their operations and real estate. By removing the need to purchase real estate, selling dealers can open the field of possible buyers tremendously because the cost of entry is significantly lowered which increases competition and increases blue sky value.

Merger & Acquisition Support:

Rely on Capital Automotive’s Underwriting

Capital Automotive can play an integral role during the due diligence phase of a pending merger or acquisition. By partnering with Capital Automotive, the operator can rely on Capital Automotive’s underwriting of the real estate portion of a M&A transaction, allowing full focus on underwriting the operating business.

By partnering with Capital Automotive, operators can significantly lower their capital investment in an acquisition, thereby increasing the return profile and expanding the universe of possible acquisition targets.

Should an operator decide to sell the business, the seller can maximize sale proceeds by bifurcating the sale of their operations and real estate, thereby reducing the cost of entry and expanding the pool of potential buyers.

Construction Funding:

Remodel or Expand Facilities

Capital Automotive provides capital for additional investments to a property during or after the initial investment. Capital Automotive’s flexibility allows operators to remodel or expand facilities whenever necessary, while preserving operators’ capital and credit for other needs. Similar to a construction loan, Capital Automotive can fund costs as incurred or simply fund the entire cost of a project upon its completion.